Nasdaq’s Board Diversity Rules - A Brief Overview

On August 6, 2021, the Securities and Exchange Commission ("SEC") approved The Nasdaq Stock Market, LLC’s ("Nasdaq’s") proposed Board Diversity and Disclosure Rules (the “Diversity Rules”). The new Diversity Rules have been added to the Nasdaq Listing Rules as Rules 5605(f) and 5606.

The Diversity Rules consist of two parts:

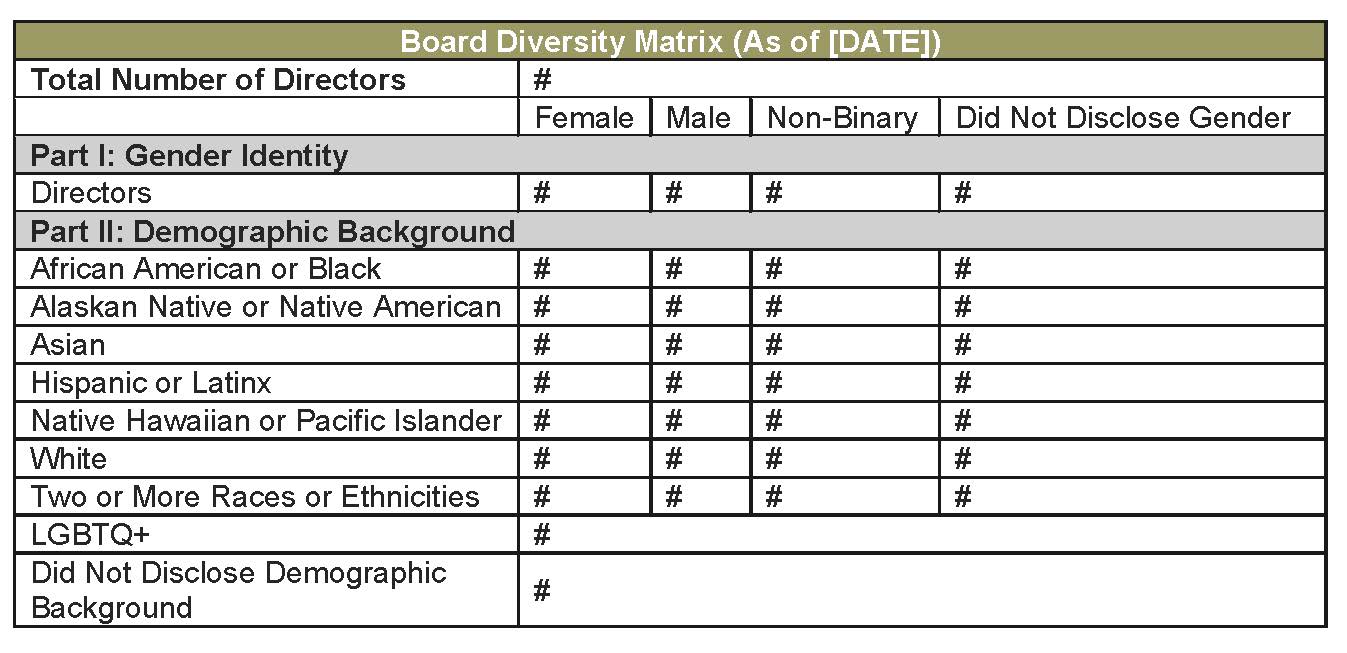

- disclosure of board diversity data is required to be presented in the form of a matrix specified under the Nasdaq Listing Rules; and

- a Nasdaq listed company must meet certain minimum diversity rules, or explain why it does not meet this requirement.

The Diversity Rules will become effective in August 2022, subject to certain exceptions which are discussed in detail below.

Disclosure Rules

Each listed company, with some exceptions, is required to disclose annually, to the extent permitted by applicable law, information regarding each director’s self-identified gender, race and LGBTQ+ status using Nasdaq’s board diversity matrix (or a substantially similar format). The form of matrix is set forth below:

Companies are required to make the initial disclosure of the board diversity data by the later of August 8, 2022, or the date the company files its proxy or information statement for its annual meeting of shareholders during the 2022 calendar year (or its Form 10-K or Form 20-F, as applicable, if it does not file a proxy or information statement for its 2022 annual meeting of shareholders). The information may be disclosed in the annual meeting proxy statement or information statement (or Form 10-K or Form 20-F) or on the company’s website. Companies that elect to provide the disclosure on their website must submit a URL link to the disclosure through the Nasdaq Listing Center within one business day after posting. In subsequent years after the initial year of disclosure, companies must disclose both the current year and immediately prior year diversity statistics.

Issuers with principal executive offices outside the United States may elect to use an alternative Nasdaq board diversity matrix. Under this matrix, the company may show the number of directors who self-identify as an “underrepresented individual in home country jurisdiction” instead of using the race and ethnicity categories for U.S. issuers. If a foreign issuer is prohibited by its home country rules to collect or disclose such diversity information, then it is not required to disclose the data but instead may indicate in the alternative matrix that disclosure is prohibited and will not be provided.

Minimum Diversity Requirements

In addition to the board diversity matrix, the Diversity Rules require each listed company, subject to certain exceptions, to have, or explain why they do not have, at least two members of the board who are diverse, including:

- at least one director who self-identifies as Female; and

- at least one director who self-identifies as an “Underrepresented Minority” or LGBTQ+.

For purposes of the Diversity Rules, “Female” means an individual who self-identifies her gender as a woman, without regard to the individual’s designated sex at birth. “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities. “LGBTQ+” means any individual who self-identifies as any of the following: lesbian, gay, bisexual, transgender, or a member of the queer community. Companies must present this information in Nasdaq’s board diversity matrix or a substantially similar format.

Where a listed company determines instead to explain why it does not meet the applicable diversity requirement, Nasdaq will not evaluate the substance or merits of that explanation. However, companies must detail the reasons why they do not have the applicable number of diverse directors instead of merely stating that they do not comply with the Board Diversity Objective Rule.

Exceptions

The aforementioned minimum diversity requirement does not apply to certain issuers including: asset-backed issuers and other passive issuers, cooperatives, limited partnerships, management investment companies and issuers of non-voting securities. Additionally, the Diversity Rules provide flexibility for smaller reporting companies, companies with smaller boards and foreign issuers. Smaller reporting companies (as defined in Rule 12b-2) can meet the minimum diversity requirement by having at least two female directors, or one female director and a second director who is an underrepresented minority or a member of the LGBTQ+ community.

A company with board composition of five or fewer members must have at least one member of its board of directors who is diverse, who can be either a female, an underrepresented minority or a member of the LGBTQ+ community. The diverse director can also be appointed as the sixth director on the board without triggering additional diversity requirements.

Foreign issuers can meet the requirement by having at least two female directors, or one female director and one director who is either (i) an underrepresented individual (based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country of the company’s principal executive offices), or (ii) a member of the LGBTQ+ community.

Any company that ceases to be an exempt company, a smaller reporting company or a foreign issuer will be given a grace period of one year to satisfy the applicable minimum diversity requirement.

Transition / Phase-In Periods

The Diversity Rules provide for a transition period for listed companies to comply with the minimum diversity requirements. The transition periods are based upon the company’s market tier as follows:

- Companies listed on the Nasdaq Global Select Market and the Nasdaq Global Market and the Nasdaq Capital Market must have, or explain why they do not have, at least one diverse director by the later of August 7, 2023 or the date the company files its proxy or information statement (or, if the company does not file a proxy, its Form 10-K or 20-F) for the company’s annual shareholders meeting in 2023.

- Companies listed on the Nasdaq Global Select Market or the Nasdaq Global Market must have, or explain why they do not have, at least two diverse directors by the later of August 6, 2025 or the date the company files its proxy or information statement (or Form 10-K or 20-F) for the company’s annual shareholders meeting in 2025.

- Companies listed on the Nasdaq Capital Market must have, or explain why they do not have, at least two diverse directors by the later of August 6, 2026 or the date the company files its proxy or information statement (or Form 10-K or 20-F) for the company’s annual shareholder meeting in 2026.

Phase-in periods for newly-listed companies to comply with the minimum diversity requirement are as follows:

- Companies newly listing on the Nasdaq Global Select Market or Nasdaq Global Market must have, or explain why they do not have, at least one diverse director by the later of one year from the date of listing or the date the company files its proxy or information statement (or, Form 10-K or 20-F) for the company’s first annual meeting of shareholders subsequent to the company’s listing. Such companies must have, or explain why they do not have, at least two diverse directors by the later of two years from the date of listing or the date the company files its proxy or information statement (or, Form 10-K or 20-F) for the company’s second annual meeting of shareholders subsequent to the company’s listing.

- Companies newly listing on the Nasdaq Capital Market must have, or explain why they do not have, at least two diverse directors by the later of two years from the date of listing or the date the company files its proxy or information statement (or Form 10-K or 20-F) for the company’s second annual meeting of shareholders subsequent to the company’s listing.

- A company newly listing on the Nasdaq Global Select Market, the Nasdaq Global Market and the Nasdaq Capital Market that has a board of five or fewer members must have, or explain why it does not have, at least one diverse director by the later of two years from the date of listing or the date the company files its proxy or information statement (or Form 10-K or 20-F) for the company’s second annual meeting of shareholders subsequent to the company’s listing.

If a company fails to satisfy the Diversity Rules by either meeting the minimum diversity requirement or disclosing why it does not meet the diversity requirement by the deadlines set forth in the transition/phase-in periods, Nasdaq will notify the company of a deadline to cure the deficiency and regain its compliance, which if not met, will result in a delisting determination. This notice would also require a listed company to file a Current Report on Form 8-k disclosing the delisting determination. Nasdaq has established that the deadline to cure is the later of the company’s next annual meeting or 180 days from the event that caused the deficiency.

Listed companies that no longer meet diversity requirements due to a board vacancy will have until the later of one year from the date of vacancy or the date the company files its proxy or information statement (or Form 10-K or 20-F) in the calendar year following the year of the date of vacancy, to resume compliance. This reliance on the one year grace period must be disclosed in the company’s proxy or information statement or on its website.

Practical Considerations

Companies need to be cognizant of the new Diversity Rules and assess whether to make any changes regarding the composition of their boards. As the 2022 proxy season approaches, companies need to provide opportunities for board members to self-identify diversity characteristics for the matrix, either by utilizing the Directors & Officers Questionnaire or a separate survey. Either way, due to the privacy concerns, companies should consider whether the diversity data should be subjected to more stringent confidentiality requirements.

Contact

Please contact Robert A. Schwartz, Gregory T. Krauss or Grace Sackey Ansah to inquire further regarding this topic.

Disclaimer

In some jurisdictions, this material may be deemed as attorney advertising. Past results do not guarantee future outcomes. Possession of this material does not constitute an attorney / client relationship.